Smarter, Faster, Fully Auditable KYC. Powered by TRIYO.

TRIYO transforms fragmented KYC operations into a unified, automated workflow — eliminating repetitive tasks, improving oversight, and ensuring every verification is accurate, auditable, and regulator-ready.

KYC Shouldn’t Slow You Down

Financial institutions are buried under manual KYC reviews, fragmented data, and inconsistent reporting. Legacy systems don’t talk to each other, leaving teams chasing documents and regulators demanding more transparency.

Data Silos and Incomplete Customer Records

Customer information is scattered across legacy systems, emails, and manual files — making verification slow, inconsistent, and prone to gaps.

Manual Verifications and Duplicated Effort

Analysts spend hours chasing documents, re-checking information, and repeating the same steps across multiple systems.

Missed Updates to Regulatory Requirements

Constantly evolving compliance rules make it difficult to stay aligned and error-free.

Lack of Real-time Visibility or Auditability

Without a centralized view, KYC teams struggle to track progress, spot bottlenecks, or prove compliance during audits.

One Step Ahead

By transforming operational and compliance data into structured, governed datasets, TRIYO makes KYC the first step toward AI-driven insights, risk monitoring, and smarter member engagement.

A Connected, Automated

KYC Framework

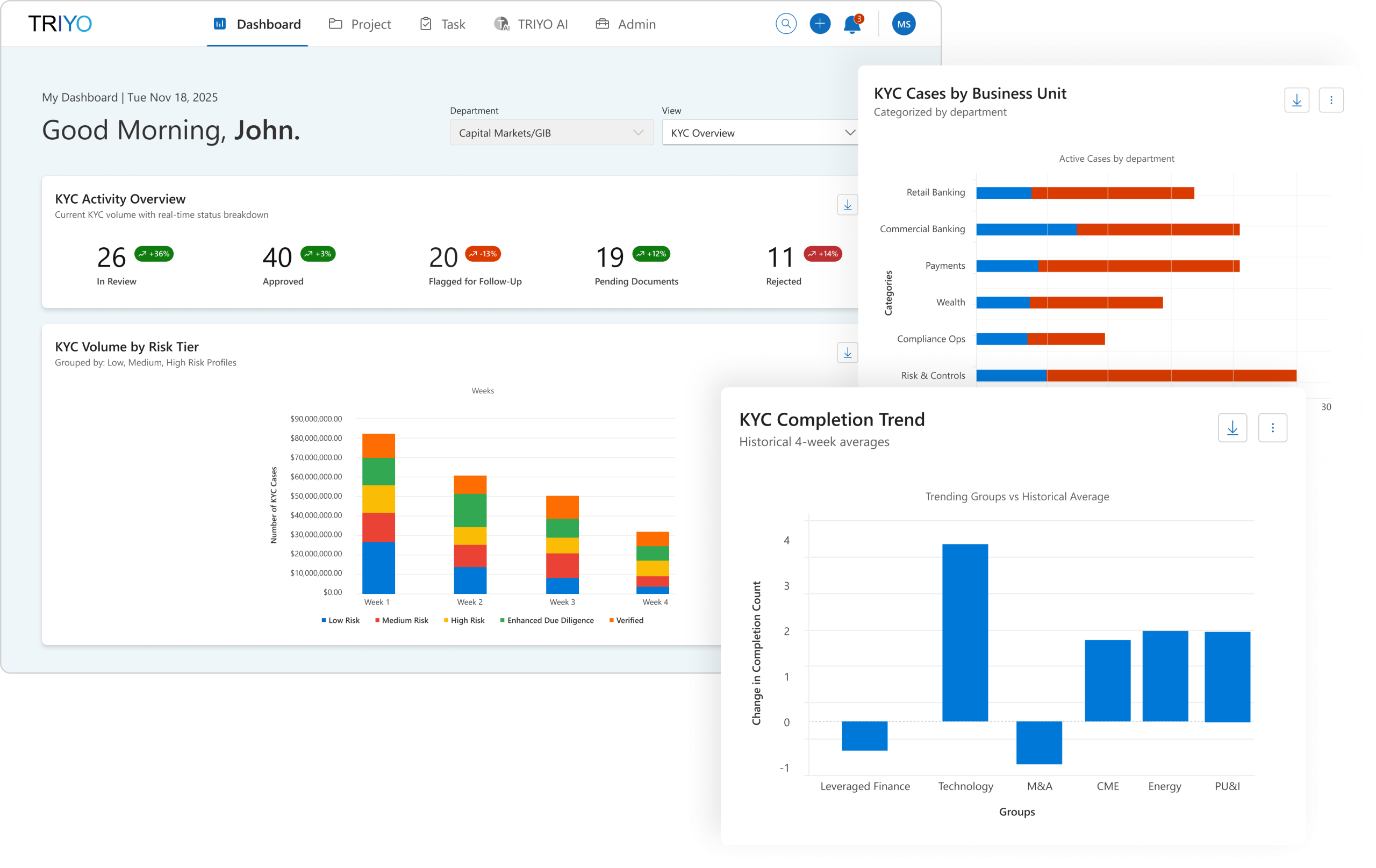

Real Time Live Reporting

Turn every KYC interaction into insight. TRIYO captures and reports data in real time, empowering teams to make informed, data-driven decisions instantly.

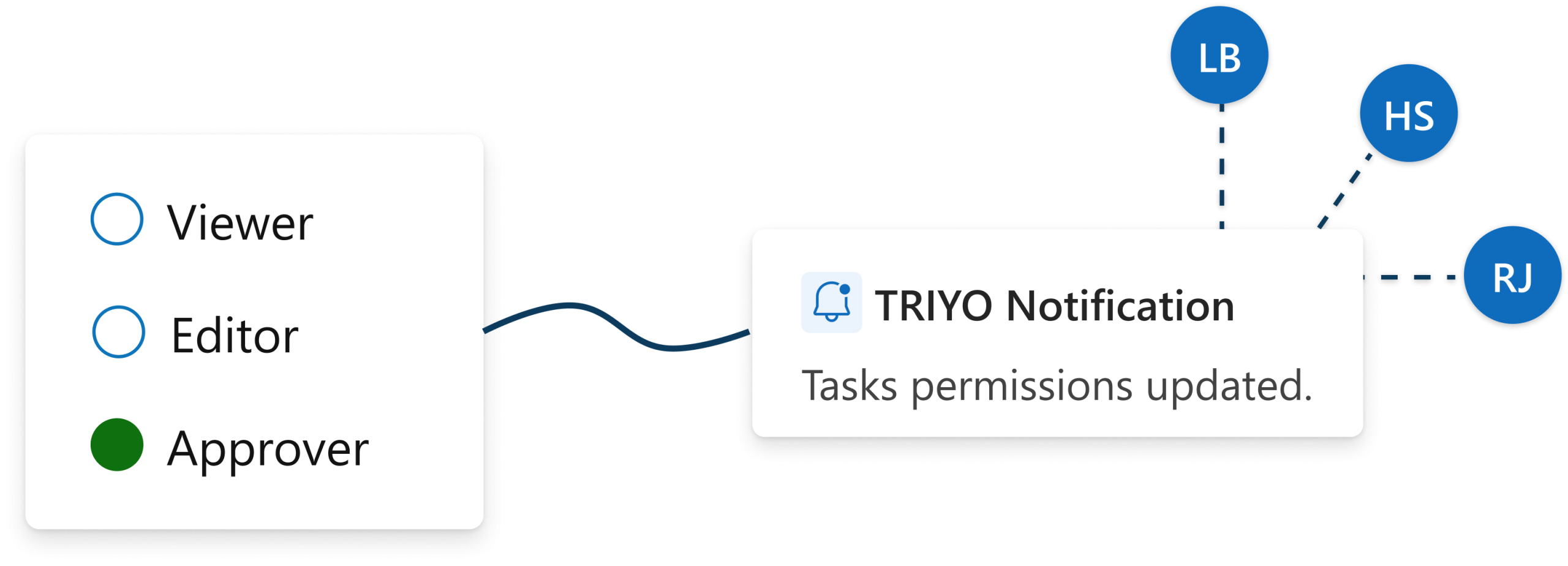

Configurable No-code Workflows and Notifications

Update permissions or create new tasks on the fly, while live notifications keep you updated on every status change, including new team members added to the process.

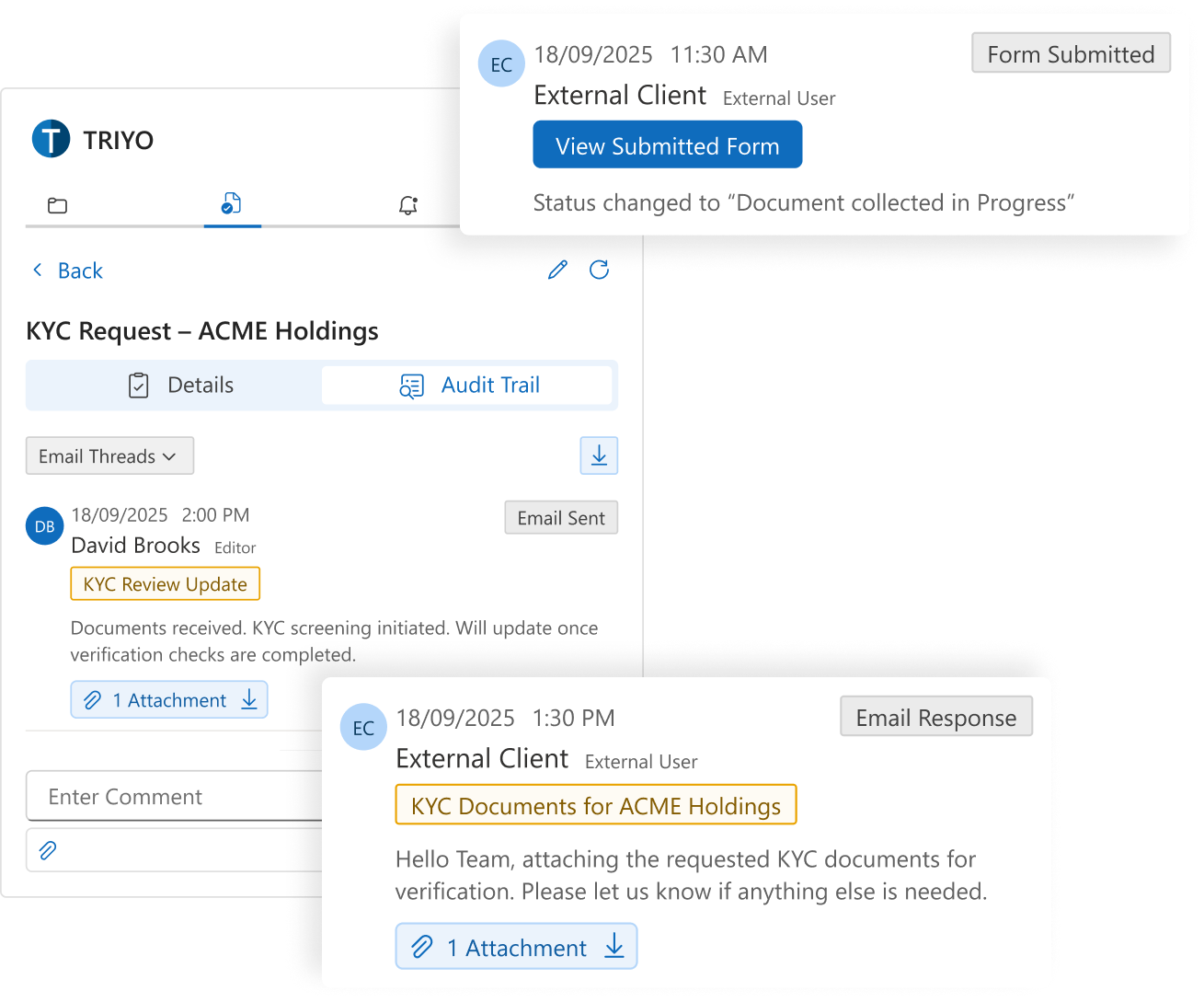

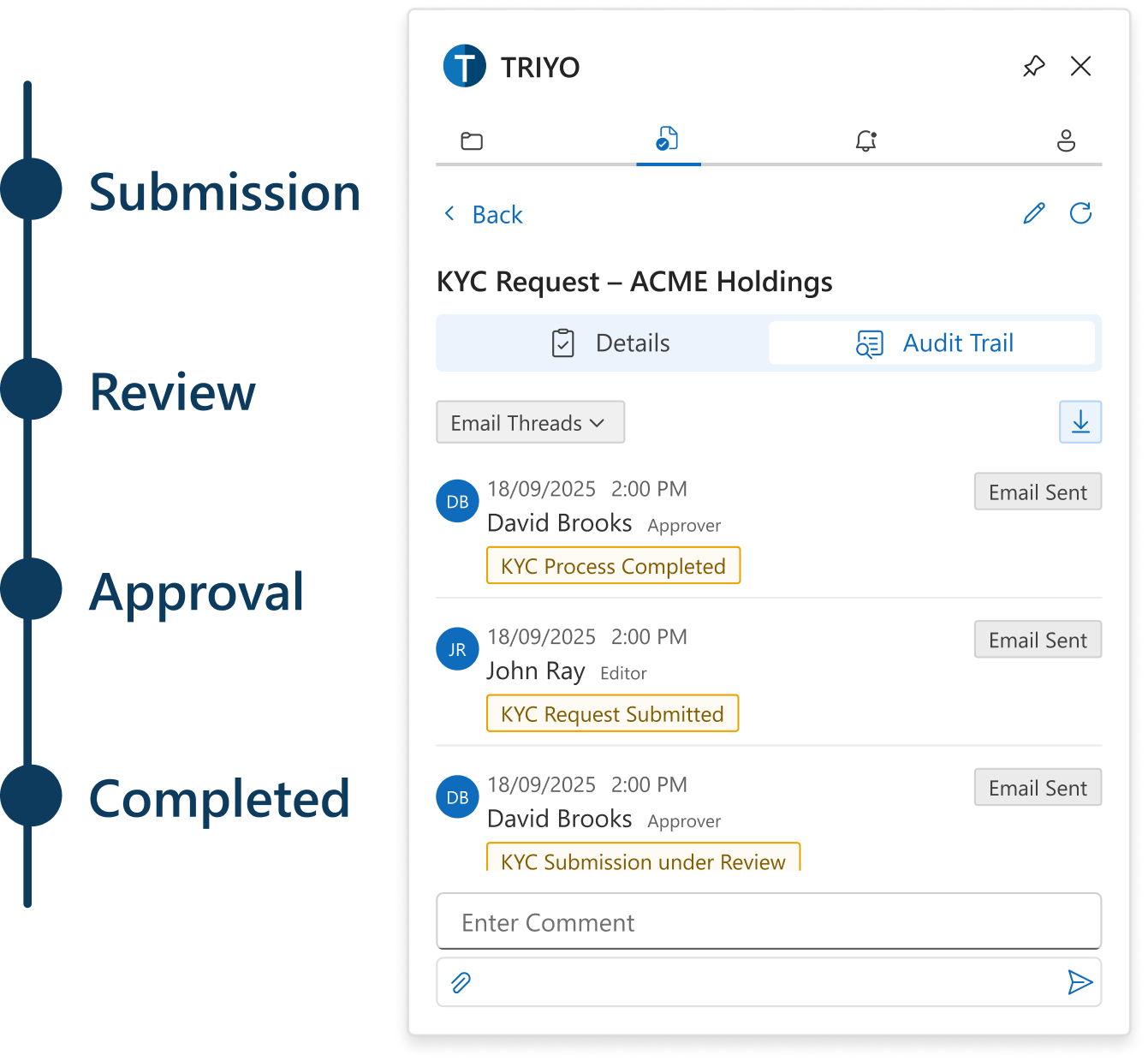

Seamless Tracking

Never lose sight of a single request. From the moment a KYC is sent, TRIYO tracks its progress through a centralized dashboard that is accessible even within your email. Teams get full visibility into what’s pending, what’s complete, and where action is needed next.

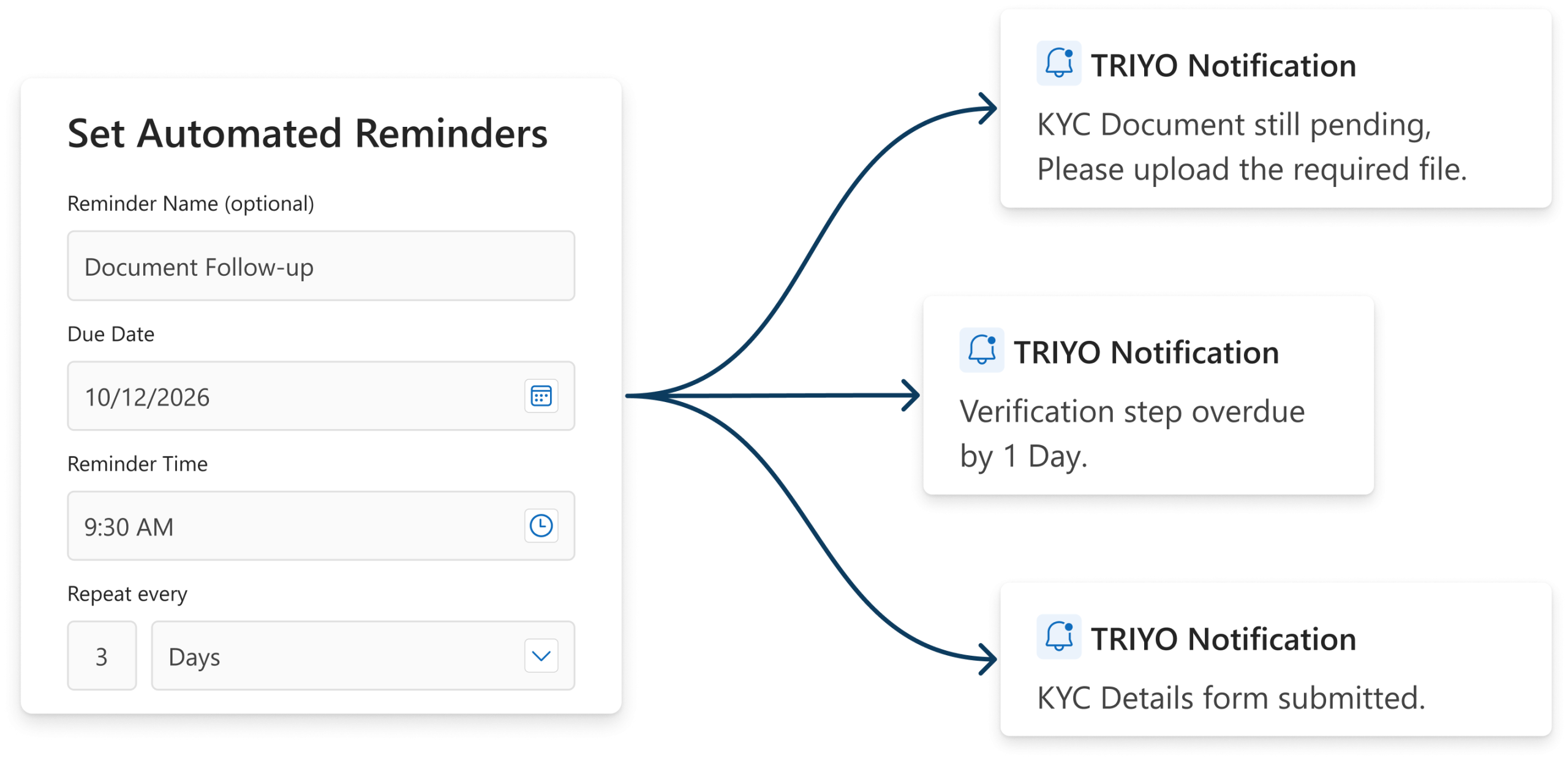

Automated Reminders

Eliminate manual follow-ups and let TRIYO handle the nudges. Set automated reminders for each KYC request, ensuring no step is missed and responses arrive on time. Free your team from repetitive tasks and focus on higher-value analysis.

Complete Transparency

Gain a 360° view of every KYC request from initiation to approval. Instantly identify delayed submissions, view communication history, and track progress across stakeholders. Every email reply, update, and action is logged automatically, giving you a complete audit trail and full confidence in compliance accuracy.

Ready to Redefine KYC?

Get in touch with our team to see how TRIYO automates compliance, enhances oversight, and future-proofs your KYC operations.