Modernize Operations.

Scale with Confidence.

Banks and financial institutions face rising regulatory scrutiny and operational complexity, TRIYO provides the data foundation and automation needed to reduce risk, boost efficiency, and accelerate AI adoption — all without disrupting existing systems.

The Challenges Holding Financial Institutions Back

High Regulatory Pressure

Financial institutions face stricter reporting standards and increased regulator scrutiny, requiring faster, cleaner, and more defensible data.

Fragmented Data Across Legacy Systems

Critical information sits across disconnected platforms, communication channels, and manual processes, making oversight difficult.

Inefficient, Manual Workflows

Teams spend valuable time reconciling data, compiling reports, and performing repetitive reviews — delaying decisions and increasing operational risk.

Limited Real-Time Visibility

Leaders lack a unified operational picture, making it hard to identify bottlenecks, forecast risk, and maintain full audit readiness.

Ready to Eliminate Operational Bottlenecks?

Discover how TRIYO gives financial institutions real-time visibility, unified data, and fully automated workflows — built to operate at scale without disrupting existing systems.

How TRIYO Supports Financial Instiutions

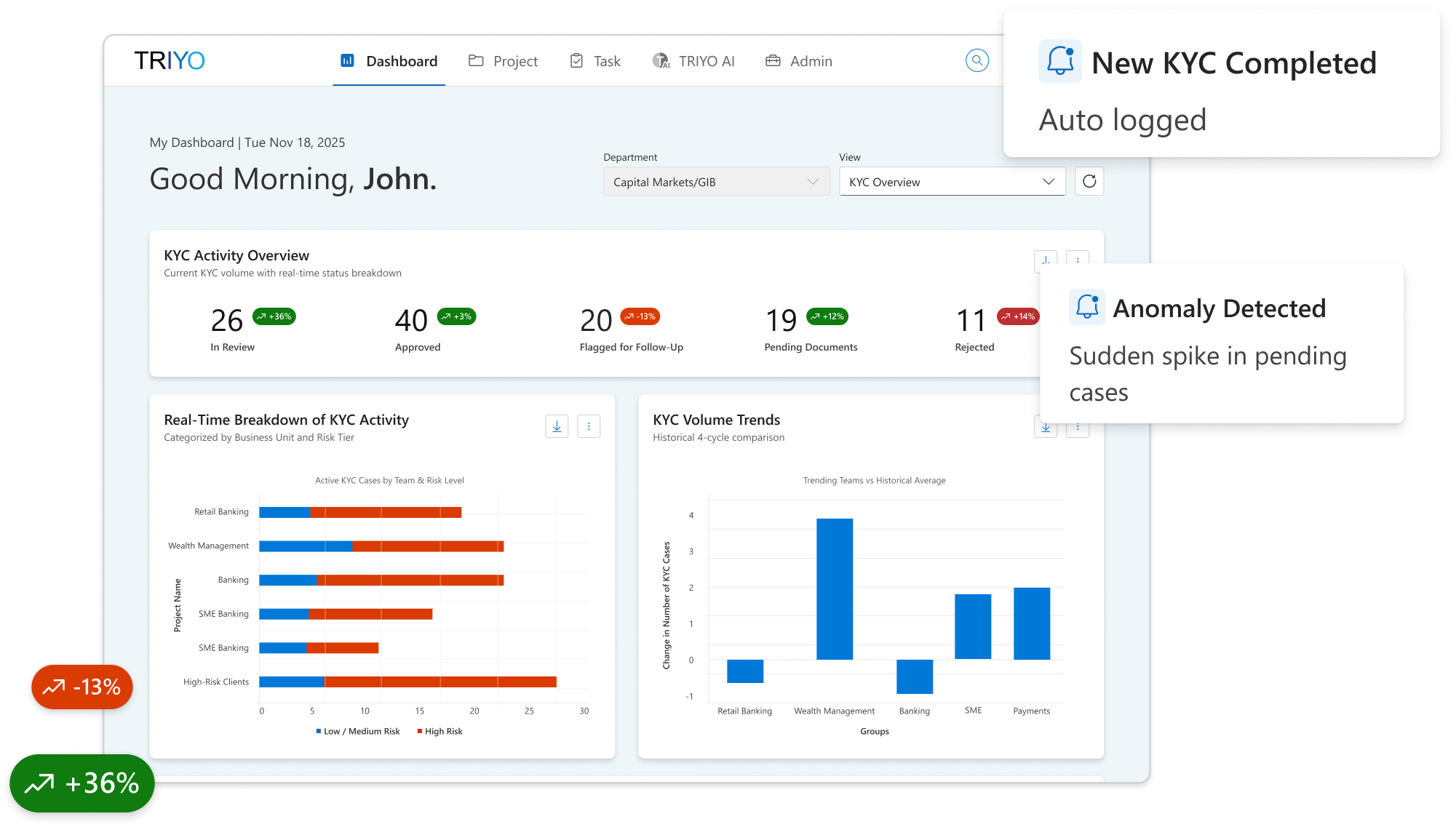

Real Time Operational Intelligence

Gain instant visibility into critical processes with TRIYO’s dynamic dashboards, automated reporting, and structured data capture. Leaders can track filings, monitor performance, and detect anomalies in real time.

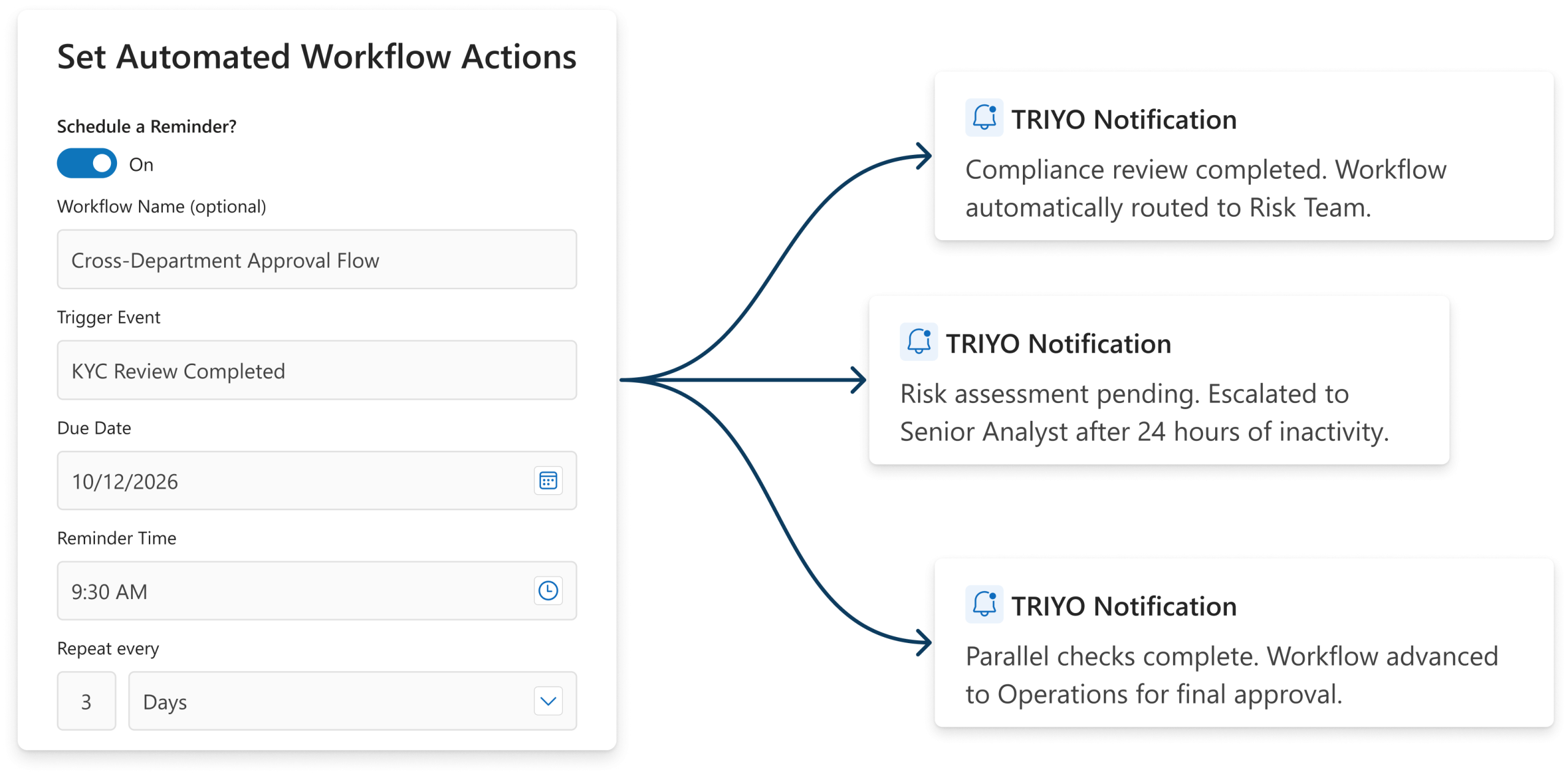

Automated Workflows Across Complex Environments

Automate operational workflows end-to-end, managing parallel workstreams, escalations, and approvals across departments. Institutions reduce manual coordination and minimize delays or incomplete submissions.

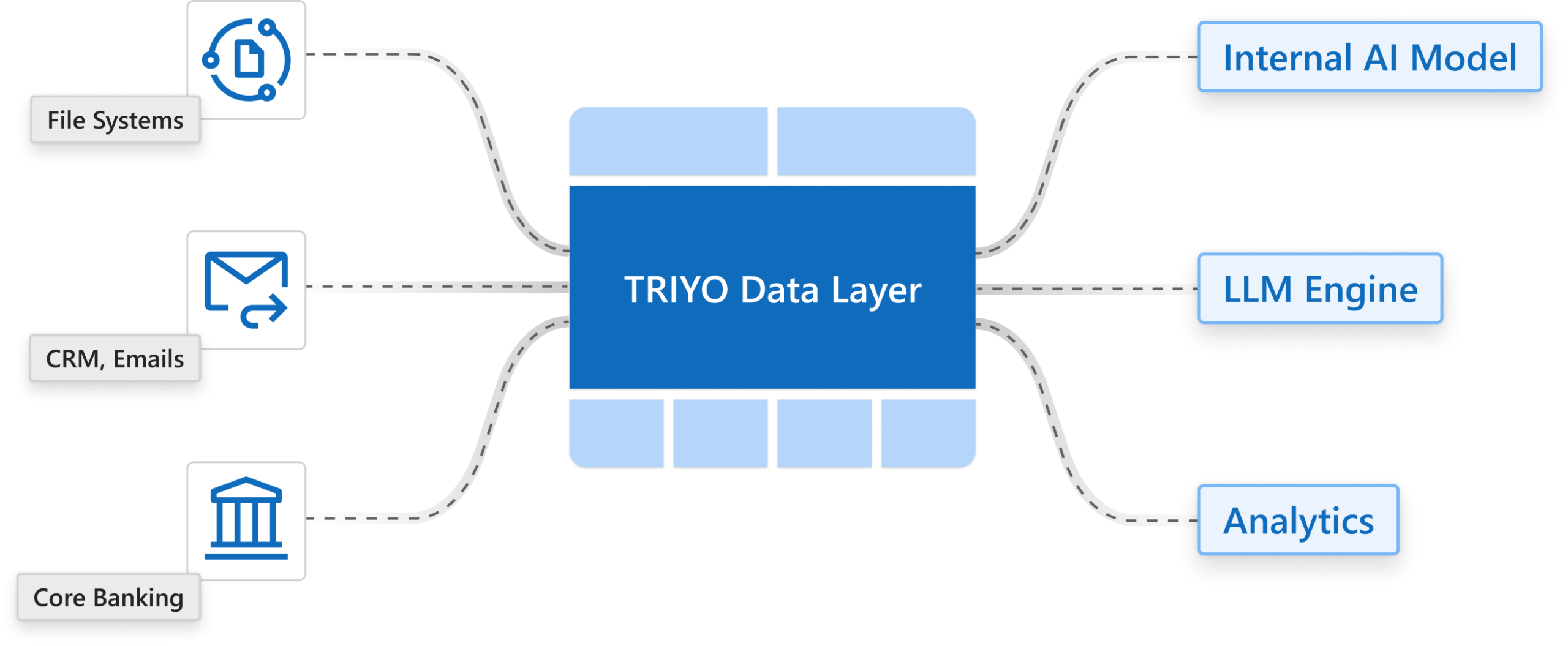

AI Ready Data Infrastructure

By overlaying legacy systems, TRIYO extracts and structures operational data into governed data lakes. Institutions gain a scalable, secure foundation for internal AI models and advanced analytics.

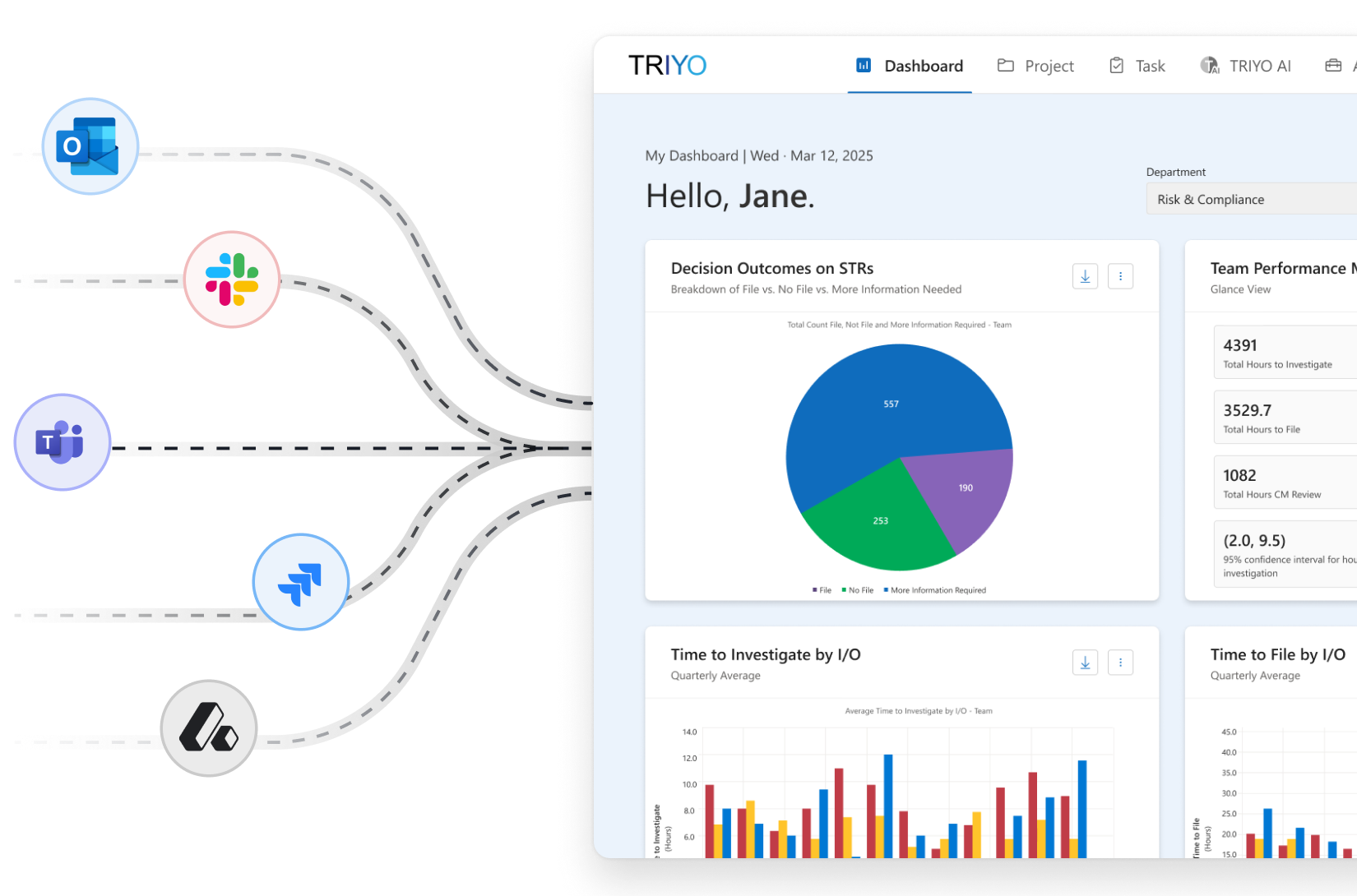

Seamless Integration With Enterprise Systems

With API-first connectivity, TRIYO integrates with core banking systems, CRMs, and communication platforms, enabling automation and AI without system replacement or downtime.

Why Leading Financial Institutions Choose TRIYO?

Built for scale, security, and real-time oversight, TRIYO helps institutions modernize operations, strengthen governance, and prepare for an AI-driven future.

-

Rapid Deployment

Rapid Deployment -

Minimal Change Management

Minimal Change Management -

Enterprise-Grade Security

Enterprise-Grade Security -

Strong Governance Controls

Strong Governance Controls

-

Built for High-Volume Teams

Built for High-Volume Teams -

Transparent, AI-Powered Decisioning

Transparent, AI-Powered Decisioning -

Scales Across Departments

Scales Across Departments -

Future-Proof

Future-Proof

Transform How Your Institution Operates Without Replacing a Single System

Streamline operations, automate reporting, and gain unified visibility across departments. TRIYO enhances your institutional performance while seamlessly fitting into the systems you already rely on.