Empower your members.

Strengthen your community.

Build trust through smarter, data-driven operations that unify compliance, collaboration, and decision-making—so your teams can focus on what truly matters: your members.

How TRIYO Empowers Credit Unions

Data Infrastructure for AI Enablement

Build a governed data foundation that powers predictive analytics, smarter reporting, and future AI adoption. TRIYO makes AI enablement compliant, scalable, and tailored to your institution.

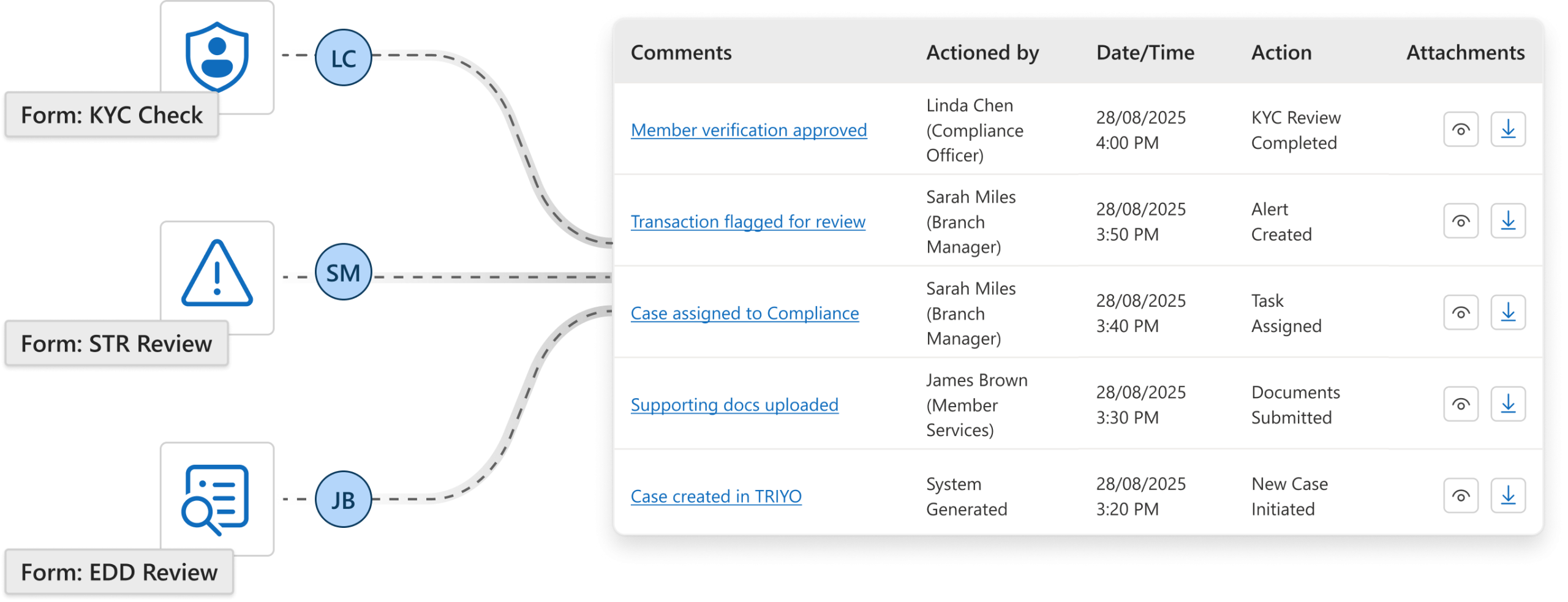

Real-Time Monitoring & Auditable Insights

Gain a centralized, real-time view of compliance activity with secure API integrations. Access verifiable audit trails and make faster, more confident decisions.

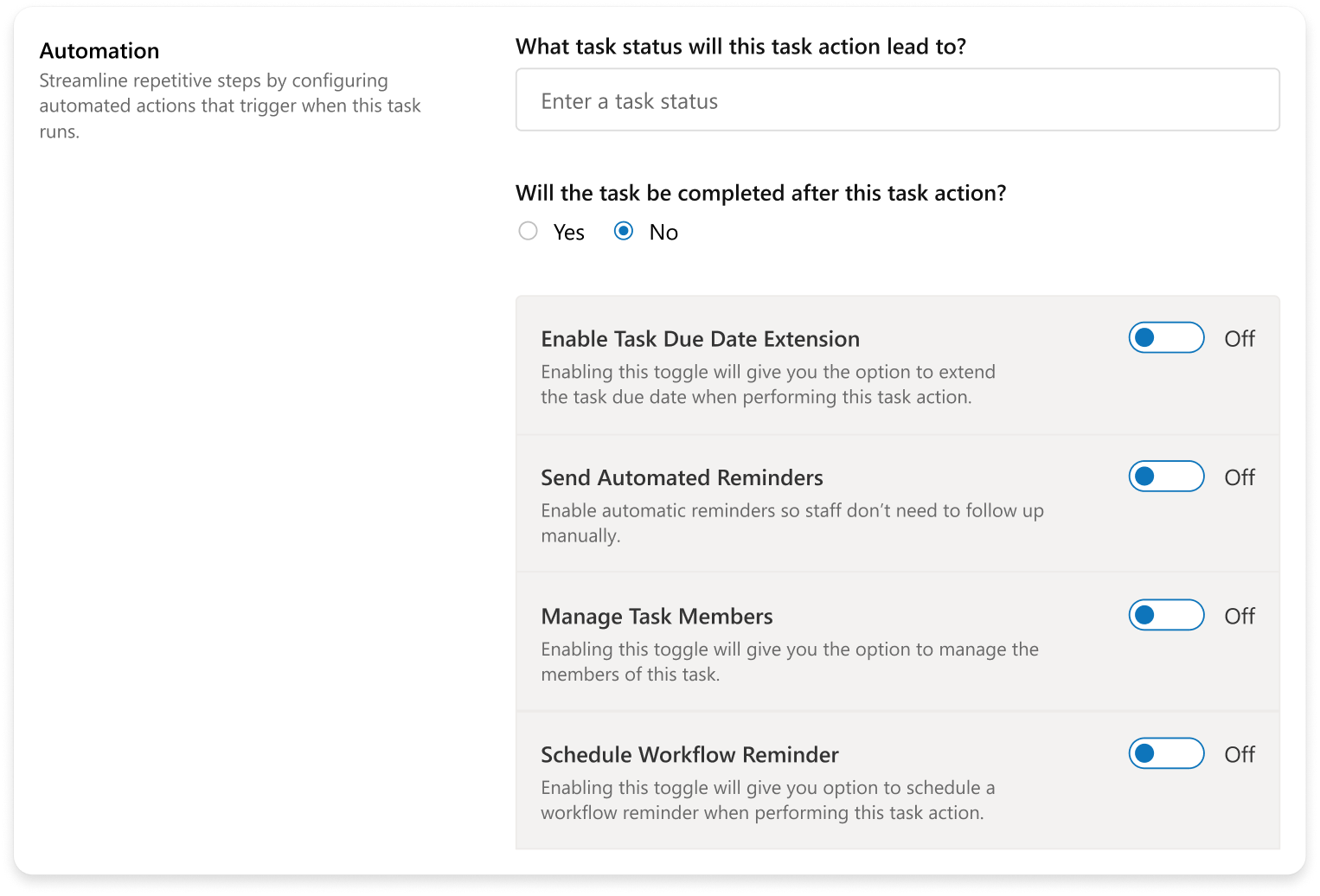

Boost Efficiency With Automation

Automate compliance workflows—from case tracking to FINTRAC submissions. Eliminate repetitive work so your team can focus on members and community impact.

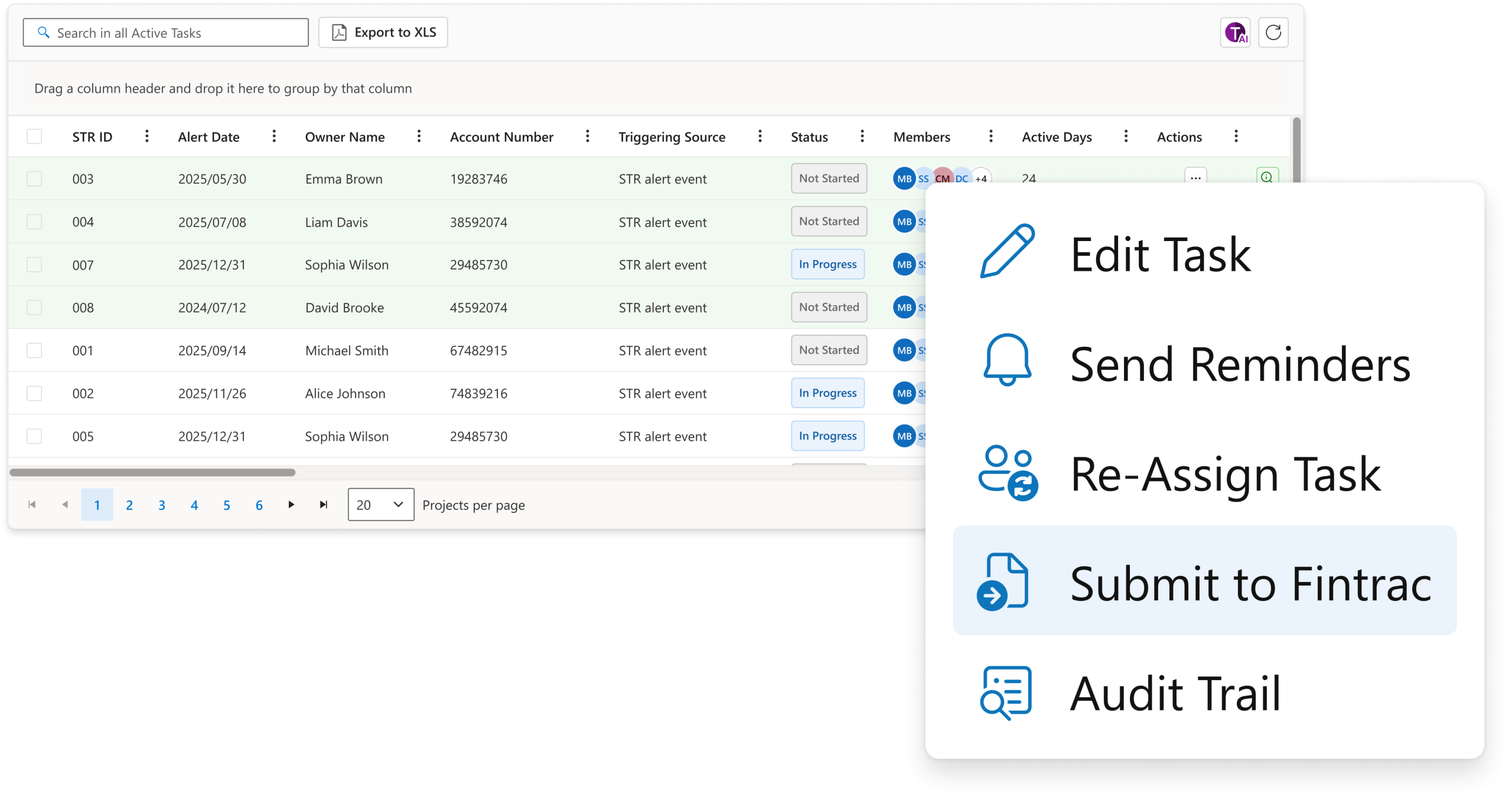

Case Management & Regulatory Reporting

Streamline every step of the reporting process. TRIYO ensures actions are logged, traceable, and audit-ready, reducing risk and improving compliance confidence.

Credit Unions Don’t Just Serve Members —

You Serve Communities.

You know your members by name and understand their needs better than any Tier-1 bank ever could. As regulations grow and resources stretch thin, TRIYO helps you do more — with less — turning your agility into an enduring advantage.

Your Challenges, Solved.

Regulatory Complexity

Compliance doesn’t have to mean compromise.

TRIYO simplifies compliance reporting through built-in validations, automated STR and KYC workflows, and direct FINTRAC submissions, ensuring accuracy and timeliness without added manual burden.

Manual Processes

Automate the repetitive. Empower the strategic.

From case tracking to regulatory submissions, TRIYO automates end-to-end workflows so your team can focus on what matters most: supporting members and strengthening your community.

Data Fragmentation

Unify data without overhauling your systems.

With TRIYO’s API-first integration, your member, transaction, and compliance data are brought together in a single, auditable view. Gain real-time visibility into compliance activities and make faster, more confident decisions, without replacing legacy systems.

Resource Limitations

Do more with the team you have.

By streamlining processes and eliminating redundant manual steps, TRIYO frees valuable staff time and reduces operational risk. The result: faster turnaround times, stronger compliance posture, and a more member-focused organization.

See How TRIYO Helps

Credit Unions Serve Members Better

Discover how TRIYO empowers credit unions to streamline compliance, boost efficiency, and focus more on what matters most — building lasting member trust.